Sky high: the story of how Sky Bet became the UK’s leading bookmaker

Twenty-five years ago this month, satellite broadcaster BSkyB jumpstarted its digital ambitions by gobbling up Sports Internet Group, including betting arm Surrey Racing. EGR hears from some of those on the frontline at the bookmaker in the early days and who played their part in the growth story of what became Sky Bet

The tech stocks frenzy of the late 1990s – otherwise known as the dotcom boom – had reached fever pitch as the world rang in the new millennium. In fact, the tech-heavy Nasdaq rocketed 86% in 1999 alone, fuelled by growing adoption of the World Wide Web, albeit via painfully slow 56k dial-up modems, and a whirlwind of IPOs involving internet startups with half-baked business models and flimsy promises of profitability.

On this side of the Atlantic, three Yorkshire-based entrepreneurs, Chris Akers, Peter Wilkinson and Jeremy Fenn, were busy trying to cash in on football club fandom and the emergence of sports betting in cyberspace. To start with, the trio raised around £2.5m to establish Sports Internet Group (SIG), a shell company they floated at 25p per share on London’s Alternative Investment Market (AIM) in March 1999. From there, SIG acquired Planet Football, which built and managed clubs’ websites, before snapping up football statistics supplier Opta.

Next on the shopping list would be a licensed offshore bookmaker to allow them to offer internet betting. “The view was gambling was going to be big on the web, so we decided to set up a business to do online betting,” Fenn says on a Teams call with EGR. “The strategy was to combine the football websites with Opta’s data analytics and layer it with betting.” After surveying a few potential targets, in late summer 1999 they pulled the trigger on a £19.7m deal for Surrey Group PLC, parent firm of bookmaker Surrey Racing. Surrey Group had a modest betting shop estate and, crucially, a coveted offshore betting licence in the Channel Islands tax shelter of Alderney.

From this remote speck on the map, the independent firm owned by bookmaker and innovator Mervyn Wilson offered a tax-free telephone betting service to swerve the 9% duty levied on customers’ bets in Britain. The Alderney operation, including a call centre and other core functions, was all run from a former hotel. Wilson’s son Taidgh, who worked there for six months and is now managing director (MD) of WilsonBet, says: “There are no large office blocks on the island, so sourcing decent accommodation for a medium-size business wasn’t the easiest task.”

Cognizant of the fact they had no bookmaking experience themselves, SIG’s founders went headhunting down the A61 from their base in Harrogate and into Leeds, home to William Hill. Fenn and Wilkinson brokered a surreptitious meeting with William Hill’s compiling and liability director, Mick Norris, and pitched the idea that the future of betting was on the internet. “Mick took a while [to buy into the vision] because he was one of the old school betting types,” says Fenn.

Eventually convinced, Norris agreed to jump ship in late 1999 to become managing director of the betting arm. Fenn adds: “I always respected his ambition and ‘balls’ to take a leap into the unknown, leaving the safety of William Hill for a startup.” Yet the SIG founders didn’t stop there; with the help of Norris, they raided Hills for further talent. That included junior trader Tim Bishop. “About nine of us resigned from William Hill on the same day – we got asked to leave the building,” Bishop says.

Another member of the mini exodus from William Hill’s trading department, who wishes to keep his name out of this article, says: “I got a shiny car and a lot more money.” Nidderdale House in the centre of Harrogate was to be the temporary nerve centre for the operation while they waited for the call centre infrastructure to be set up in nearby premises at Central House. The open-plan space at Nidderdale House was on the first floor with a dozen desks and a corner office for Norris.

“I just remember it being a startup mentality and a bit of a whirlwind,” Bishop recalls. “We were coming from an established business with all this structure around it and we basically had to recreate that from scratch.” For CEO Fenn, the hires from the esoteric world of betting were vital. He says: “Probably the most inspired decision we made was to recruit a management team that could come in and run the betting side. Even though we were this upstart internet business, there was a clear view that we needed industry knowledge and experience.”

The real deal

Despite the SurreySports.com betting platform having not yet gone live at the turn of the millennium, SIG and its acquisitions – mainly the Planet Football deal – caught the attention of large media enterprises panicking about missing out on the digital gold rush. One prominent suitor was cable TV and internet provider NTL, which kicked the tyres on the fledgling business in early 2000.

Word leaked that NTL and SIG’s founders were in discussions about a potential sale, so next to come knocking for talks was satellite broadcasting giant BSkyB. “[NTL and BSkyB] were thinking that if this internet proposition becomes something, is it a threat to TV?” Fenn recalls. “There was some intrigue about what we were doing.”

Back then, he says, crude vanity metrics like a website’s hits were the be-all and end-all. “It was all about how many clicks websites got – the whole notion of how long users spend on the site, conversion ratios and lifetime values hadn’t been invented,” he notes. In May 2000, two months after the betting platform went live with its offer of tax-free betting and a free £10 bet for new accounts – it was publicly announced that BSkyB had struck an agreement to acquire SIG in an all-share deal worth £301m.

And just like that, SIG and its assets were to be sold (the transaction completed in July 2000). The timing was especially fortuitous for SIG’s founders as the dotcom bubble had begun to implode when BSkyB first made its approach. “It did deflate pretty quickly – we probably agreed the deal right at the top of the market […] six months later it would have been a different story,” Fenn acknowledges.

Nevertheless, BSkyB had to figure out what to do with this medley of sports-related assets. The company had not long earlier launched its interactive TV service, so the thinking with Surrey Sports was to pipe betting and gaming directly into subscribers’ homes through their set-top boxes. SurreySports.com was repurposed for the Sky Digital platform and was accessed via the red button on the remote control. Looking back now, the user journey was clunky and far from intuitive.

Other betting brands, like Blue Square and Littlewoods, had commercial deals to operate on the platform, too, yet BSkyB bosses formed a 50/50 joint venture (JV) in 2001 with UK heavyweight Ladbrokes to develop exclusive fixed-odds and pool betting for Sky Digital. At the time, Ladbrokes was owned by hotel chain Hilton Group. “Because of the performance of their hotels it was just about to fall out of the FTSE 100, so the group needed some deals to help show it had momentum,” says Nick Rust, who headed up Ladbrokes’ nascent egaming unit back then.

Rust was to be installed as MD of the newly formed venture that would see BSkyB receive £30m from Ladbrokes, along with ongoing operational payments linked to betting volumes and profitability. However, the 9/11 terror attacks happened soon after and Hilton Group began to get cold feet over such a financial commitment amid tremendous economic uncertainty. A few weeks later, in early October 2001, the deal was scrapped after the UK government launched an inquiry over competition concerns flagged by rival bookmakers.

With the JV off the table and the acquired SIG assets worth a fraction of what BSkyB paid for them, the decision was made to go all-in with betting to try to justify the price paid for SIG. Having been fully acquainted with Rust before the Ladbrokes deal was aborted, he was offered the role of MD of the betting business. “I said, ‘I’ll come and do this [job] if you commit to rebranding it with Sky’s brand’,” Rust says.

So, in the summer of 2002, bosses shelved Surrey Sports for Sky Bet, though there had been some trepidation within the group about the reputational risk of a family entertainment platform attaching its name to gambling. “Sky thought we were a dirty little relative clinging onto this beautiful media empire,” is one anonymous source’s opinion. His request fulfilled, Rust took up the post and joined more than 100 colleagues in Harrogate.

Sky Bet’s shiny new interactive offering was about to go live on Sky Digital at the time, yet this was still very much an analogue outfit in 2002 thanks to the legacy telephone betting service. It was also heavily reliant on a few huge bettors as clients. Rust says: “We had two or three high rollers on the telephone who were a very significant part of the business […] we were living result by result on these punters and the whole trading team would have their head in their hands or be euphoric depending on the outcome [of results]. It wasn’t a very well-diversified business.”

Higher-ups at BSkyB overseeing Sky Bet at arm’s reach struggled to fathom why this small Harrogate subsidiary would win one week and sustain eye-watering losses the next. “I had to explain some weeks why our turnover was £5m but we’d lost £2m,” Rust remembers. “[They asked] ‘why aren’t you just hedging and managing the business in such a way that we can deliver a steady profit’? I explained we could do that, but you’d be giving away significant value from the business.

To smooth out the ups and downs, we had to grow and move towards a more sustainable business.” Together with the marketing team at Sky, they leveraged Sky’s assets and repositioned Sky Bet as a recreational bookmaker. The effect was average stakes plunged but margin increased, as did customer loyalty. “Stickiness was good; we weren’t burning through customers,” Rust notes. “They weren’t heavy users, but they were more sustainable – Sky got more comfortable with that over time.”

As bright as a button

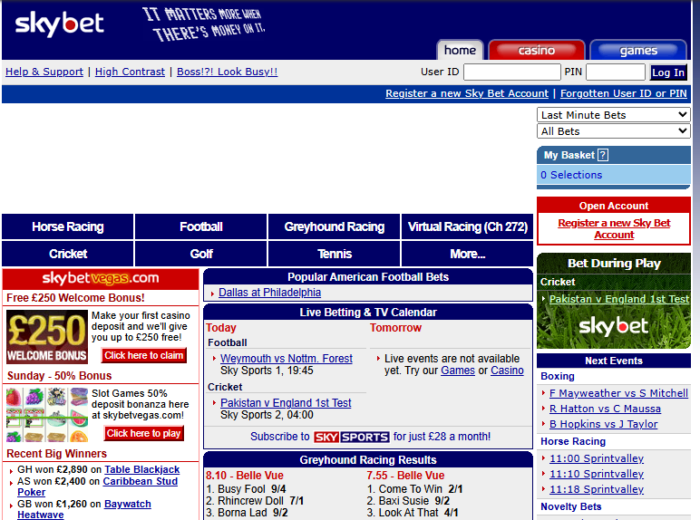

While customers could log on and have a flutter at Skybet.com, core to the brand messaging was that Sky Bet was also accessed in your living room by tapping the red button on the peculiar-shaped remote control. In fact, a red button formed part of the ‘b’ in the Skybet.com logo. Sky Bet’s slogan – ‘It matters more when there’s money on it’ – would probably never see the light of day now, but it was still a memorable and catchy hook. With Sky Bet’s red button offering starting to take off, the leadership team realised it urgently needed to expand the product range to serve up casino games for customers.

Rust says: “I remember sitting in an office in late 2002 with [deputy MD] Keith Oliver doing the maths for a fruit slot and briefing Sky’s designers on what the reels would look like, how often we wanted the 14 symbols to appear and the payouts.” Despite the final version of the game resembling “Tic-tac-toe” (aka noughts and crosses), Rust said it cleared £60,000 in profit in its first week. “We looked at ourselves and said, ‘what have we got here’?” he laughs.

“The red button was more accessible for Sky’s customers than the internet – and we had it to ourselves,” Rust adds. A few months later, in 2003, the product suite was expanded with the rollout of Sky Vegas and Sky Vegas Live on channel 864. Naturally, advancements in technology meant it wasn’t too long before gambling on your big telly at home appeared moribund. Laptops becoming more affordable and wireless routers portended the beginning of the end for the red button.

Richard Flint, who spent nearly 20 years with the business, including a decade in charge, says: “When people had a desktop PC in an upstairs room, we could compete with that. They couldn’t be bothered to go upstairs to place a bet. Even though it was clunky on the red button, they would do it. But when people had laptops next to them, it started to eat into our share. When they had mobile phones, we were toast.”

Around 2007 was when the decision was taken to shift the focus to online, resulting in a 20% cut to the workforce. The upshot was the operator became leaner and very much a tech business. Building the best possible UX across its portfolio of products was the priority, as was being highly analytical around customer acquisition and CRM. Shortly thereafter came a critical component of Sky Bet’s growth story with the launch of Super 6, the extremely popular free-to-play (F2P) prediction game associated with the Soccer Saturday TV show on Sky Sports.

Vic Wakeling, the no-nonsense MD of Sky Sports at the time, was fiercely opposed to any mention of or signposting to betting odds during a live broadcast, but Flint pondered whether a prediction game promoted by Sky Sports could be a neat way to drive Sky Bet sign-ups and user retention – and appease Wakeling.

Flint explains: “It’s about a million to one to predict six correct scores on a Saturday afternoon. If you offered [a jackpot of] £100,000 and you had enough people playing and opening accounts, it could work.” Wakeling used to play the original ITV7 game (viewers had to pick the winners of seven televised horseraces), so he was sold on the idea of Super 6. “He got behind it […] we got the Soccer Saturday producers involved and they liked it,” Flint says. Super 6 turned out to be a phenomenal hit for Sky Bet and set the industry bar for F2P games.

Another defining moment was when Sky Bet bosses fell out with their landlord over the lease in Harrogate and decided to move the company and nearly 200 employees to Leeds. That relocation in the summer of 2010 proved pivotal for staff recruitment. Bishop says: “We had a nice office in Harrogate, but it was hard to attract people to come and work there unless they were already from Yorkshire. We recruited a lot of graduates, so that was easier when we moved to Leeds. It became a much younger, vibrant company.”

Upwardly mobile

The early 2010s was when the industry had to cater to netizens migrating from PCs to smartphones and native apps, which kickstarted another boom in digital gambling. Partly to save money and not wishing to be constrained by a third-party supplier, Sky Bet chose to build its front-end on mobile in-house. It was an ambitious strategy for the time, but being able to “own the user experience” was important, Flint insists. “We had the best product out on mobile pretty early.”

Conor Grant, who joined in 2010 as head of sportsbook product management, says: “We embraced a mobile-first culture in the early part of the last decade and that gave us a competitive advantage as our technology allowed us to move faster than our competitors.”

Elsewhere, Sky Bet’s sponsorship of the Football League from the start of the 2013-14 season turbocharged the brand in the UK. So too did #RequestABet – user-generated betting markets which snowballed organically on Twitter and were the precursor of bet builders. “We were a challenger brand, and that mindset gave people the platform and confidence to push the boundaries,” says Grant.

Moreover, the pieces had begun to fall into place by now. Flint recollects: “Everything started to come together – the team, the marketing, the products and we really started to gain share at that point. We were growing 30% to 40% a year.”

Being owned by Sky (the BSkyB name was simplified in 2014) was shackling Sky Bet, though. For instance, any group hiring freeze would also apply to Sky Bet, despite the operator needing to recruit developers and engineers. Any minor upgrade to the office, like a meeting room refit, had to be approved by Sky, too. Meanwhile, liabilities on football accumulators caused an issue, Flint recalls.

“Occasionally we’d lose a lot of money. Sky’s financial year was the end of June, but they’d be so nervous about us screwing up their financial results with a bad run at the World Cup or the Euros that at one stage they asked us to stop offering accas.” It meant marketing on summer tournaments was problematic, too.

He says: “We would say ‘we want to run a World Cup campaign that costs us £2m but we’ll get back £5m in the next 12 months’, but they would say ‘we don’t care if it gives you £5m next year, you’re not a core business and we’ve got to hit our numbers’.”

In late 2014, Sky sold 80% of Sky Bet to CVC Capital Partners, a private equity firm that had previously owned William Hill and spread-betting outfit IG Index. The deal, which valued Sky Bet at £800m, gave the operator the financial backing and autonomy it needed to kick on. Within three years, Sky Bet trebled its headcount, weekly customers, and revenue and EBITDA. Over that period, marketing expenditure doubled, investment in tech tripled and the brand launched in Italy and Germany.

“It was one of the best private deals there’s ever been in the UK and one of the best CVC did – they made nine times their money,” Flint reflects. In 2018, The Stars Group (TSG) acquired what was now Sky Betting & Gaming for $4.7bn, which was a 12.8x multiple of its adjusted EBITDA the prior year. Two years later, TSG became part of Flutter Entertainment, after the two giants completed a mega-merger.

Today, Sky Bet remains a major brand in Flutter’s portfolio and has an estimated 20% share of the UK online betting market, according to Eilers & Krejcik Gaming. It also remains the most successful marriage of a media brand with betting – something many others have failed to replicate.

But for those who were there from the start and had a ringside seat on Sky Bet’s journey to become the UK’s biggest betting brand, they talk about their time at the operator with affection and nostalgia. “If I go out with a group of ex-Sky Bet people now, they still rave about what it was like then,” says Bishop, who spent 19 years at the company.

“It was the team and culture,” says Flint. “I still live in Harrogate, and I bump into people who say it was the best experience of their working lives.” As for Yorkshire entrepreneur Fenn, who left the group 18 months after the BSkyB deal, he says Sky’s involvement was critical. “I’m not sure that independently it could have delivered what Sky ultimately delivered.” He concludes: “It was an amazing time. I don’t think any of us will ever be involved in anything like it again […] it was a moment in time.”