New Jersey sports betting revenue surges 47% in August despite offseason lull

Latest DGE data shows double-digit growth in both igaming and sports betting as total gaming revenue increases 13%

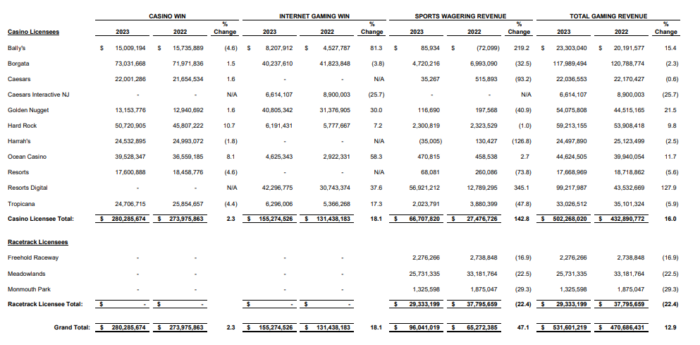

New Jersey’s sports betting operators saw sports betting revenue growth of 47% year on year (YOY) during August, reporting gross gambling revenue (GGR) of $96m, according to latest data from the New Jersey Division of Gaming Enforcement (DGE).

Total gambling revenue, inclusive of all forms of gambling at both casino and race track operators grew 13% YOY from $470.7m in August 2022 to $531.6m in August 2023.

Statewide internet gaming revenue rose by 18% YOY to $155.3m in August, ahead of land-based casino gambling revenue, which grew by 2% to $280.3m over the same period.

Drilling down into the individual August numbers by operator, Resorts Digital continued its reign as the biggest revenue generating sportsbook in the month, reporting a 345% upsurge in revenue to $56.9m during August.

Bally’s took the silver medal position in terms of sportsbook revenue in August, reporting a 219% YOY increase in its revenue to $85,934, markedly ahead of the Ocean Casino, the only other operator to report a YOY percentage revenue increase in the month, rising 3% to $470,815.

Of those sportsbooks reporting revenue drops during the month, Harrah’s was the biggest, confirming a 127% slump in its revenue to a negative $35,005, followed by Caesars, which saw its August sportsbook revenue fall 93% YOY to just $35,267.

New Jersey’s race track sportsbooks all posted double-digit revenue declines during August, with Monmouth Park reporting a bigger decline than its two counterparts, Meadowlands and the Freehold Raceway.

In respect of igaming, Bally’s reported the biggest percentage increase in its igaming revenue during August, with revenue growing 81% YOY to $8.2m, way ahead of the Ocean Casino, which reported a 58% increase in its own igaming revenue over the same period to $4.6m.

The igaming revenue wooden spoon during August was won by Caesars Interactive New Jersey, which saw a 25% YOY revenue drop to $6.6m.

New Jersey’s land-based casino win rose by just over 2% to $280.3m, punctuated by a 3% uptick in slot machine win to $210m and a more modest 0.2% increase in table game win to $69.6m.